Table of Contents

- CPI Chart - Finance & Technology Investment Bank in New York, NY ...

- June Inflation Preview: The Path To The Fed's 2% PCE Goals Is Getting ...

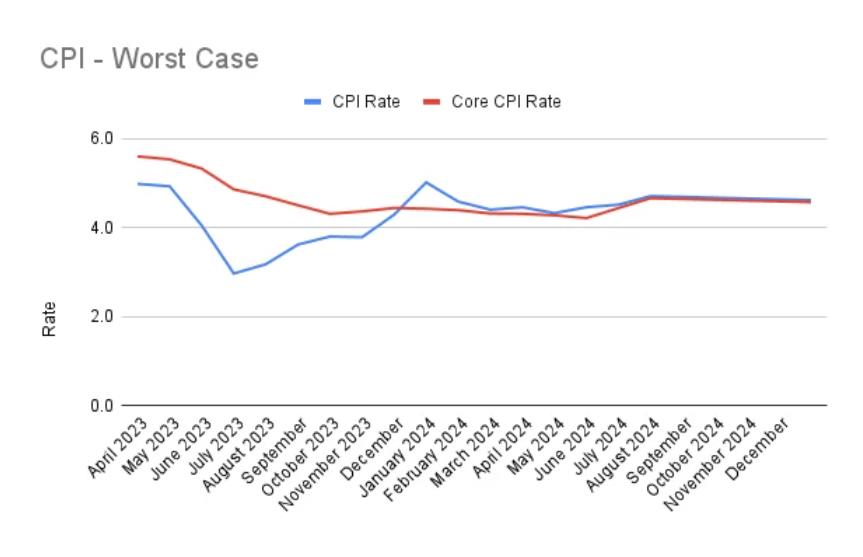

- Forecast

- Economic and Fiscal Overview | Budget 2024

- 2024 Cpi Release Dates Australia - Jan Rozella

- This Is Why We’re (Still) Not Worried About an Inflation Resurgence ...

- CPI will reach 4% in January 2024 according to best case analysis – How ...

- October 2024 Cpi - Nesta Adelaide

- Consumer Price Index (CPI) for February 2024 is Projected to Rise 3.1% ...

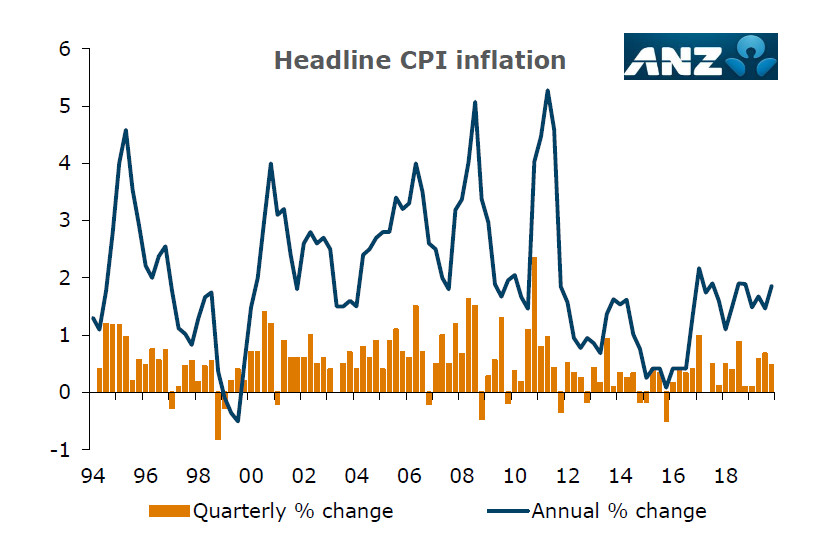

- Stronger-than-forecast CPI gives the RBNZ time | BusinessDesk

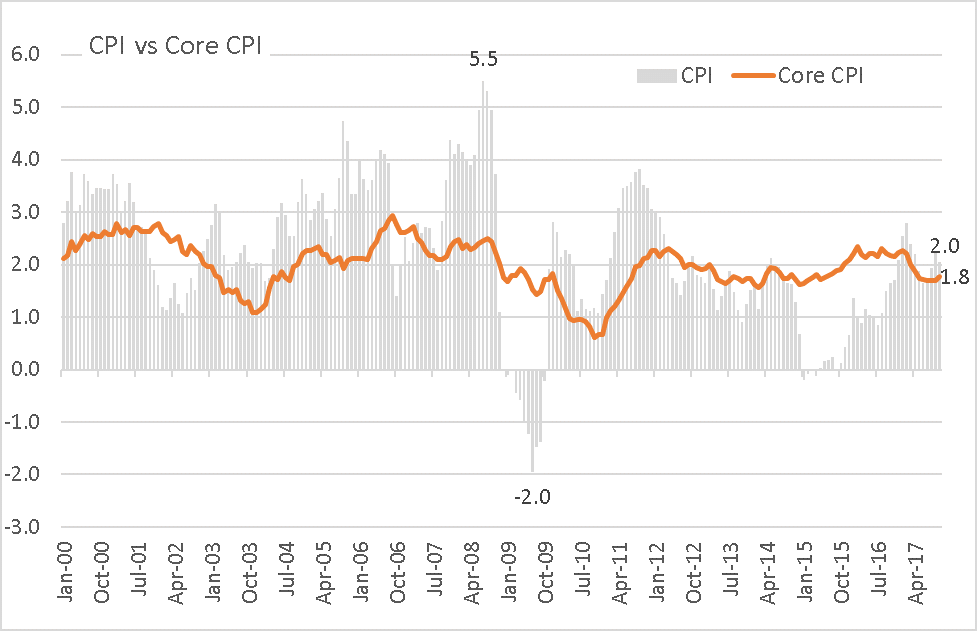

Understanding the Consumer Price Index

Monthly CPI Analysis

Insight/2024/03.2024/03.11.2024_Consumer Price Index/03-number-of-s%26p-500-companies-citing-inflation-on-earnings-calls-versus-quaterly-cpi-year-over-year-nsa.png?width=2016&height=1152&name=03-number-of-s%26p-500-companies-citing-inflation-on-earnings-calls-versus-quaterly-cpi-year-over-year-nsa.png)

The following chart from YCharts illustrates the monthly CPI growth rate over the past year:

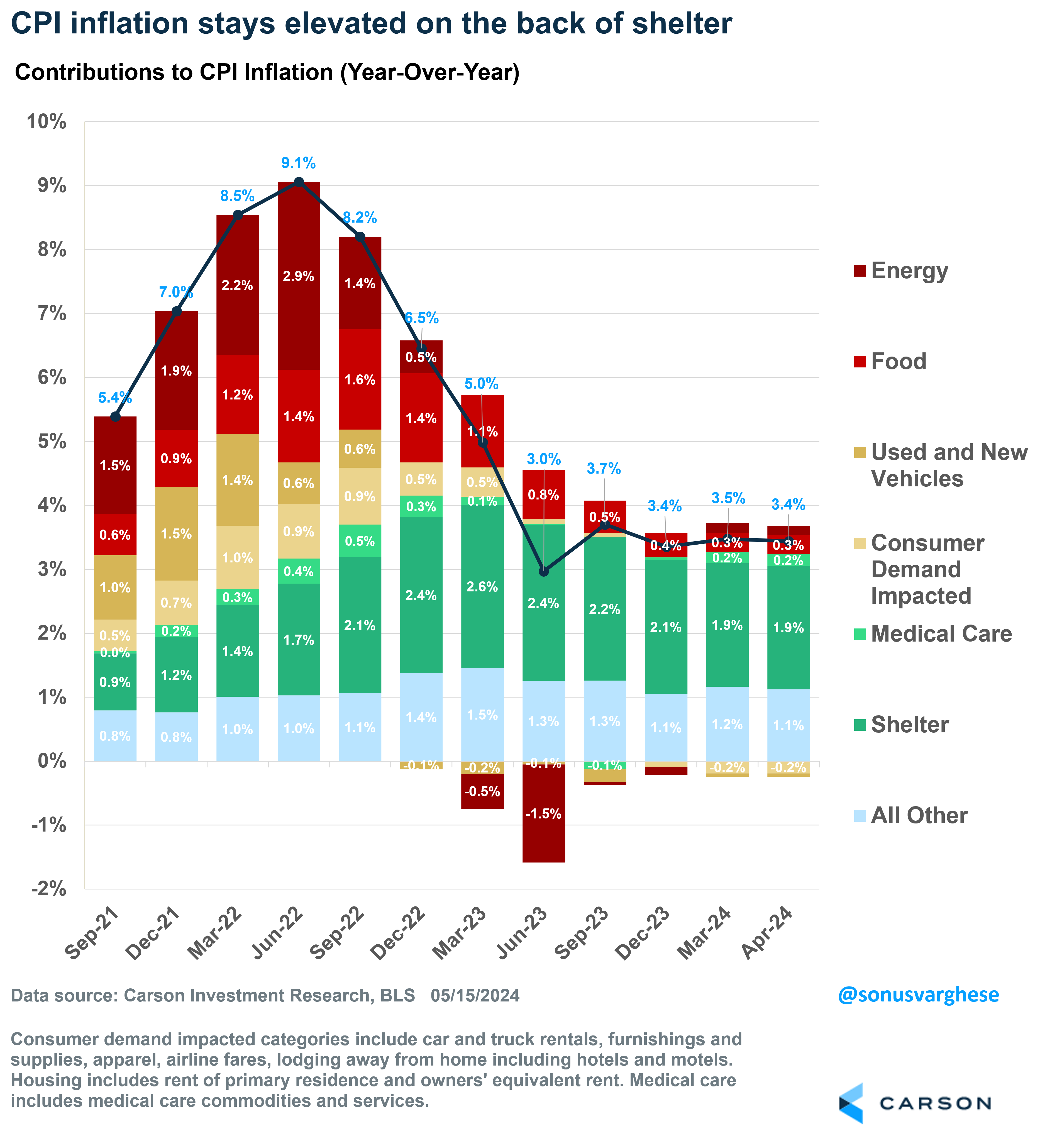

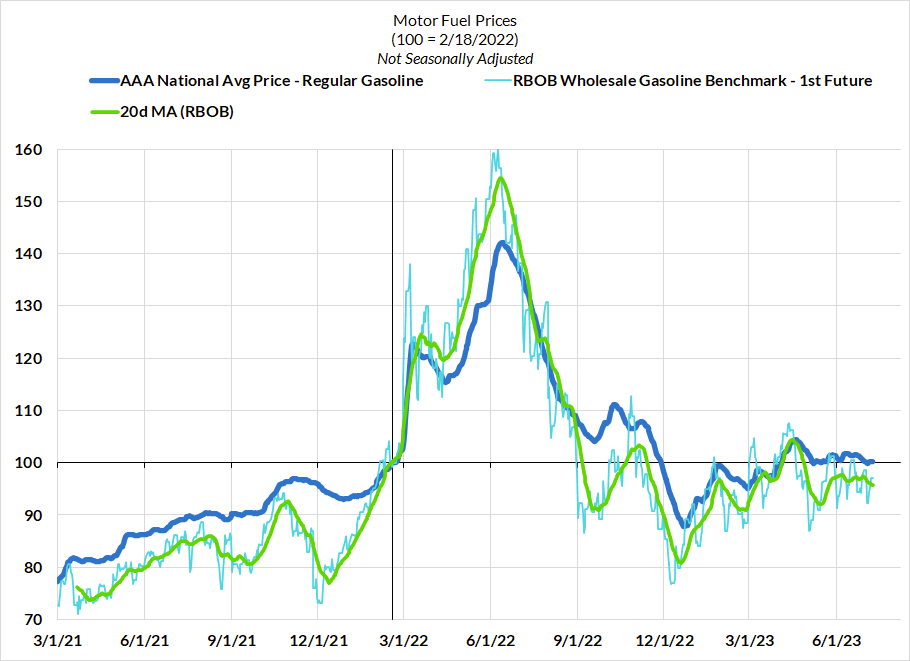

Key Drivers of Inflation

So, what are the key drivers of inflation in the US economy? The data from YCharts suggests that housing and healthcare costs have been significant contributors to the increase in the CPI. The shelter index, which accounts for the largest share of the CPI basket, has been rising steadily, driven by increases in rents and owner-occupied housing costs.Additionally, healthcare costs have been a major driver of inflation, with the medical care index increasing by over 3% in the past year. The following chart from YCharts shows the breakdown of the CPI by category:

Implications for the Economy

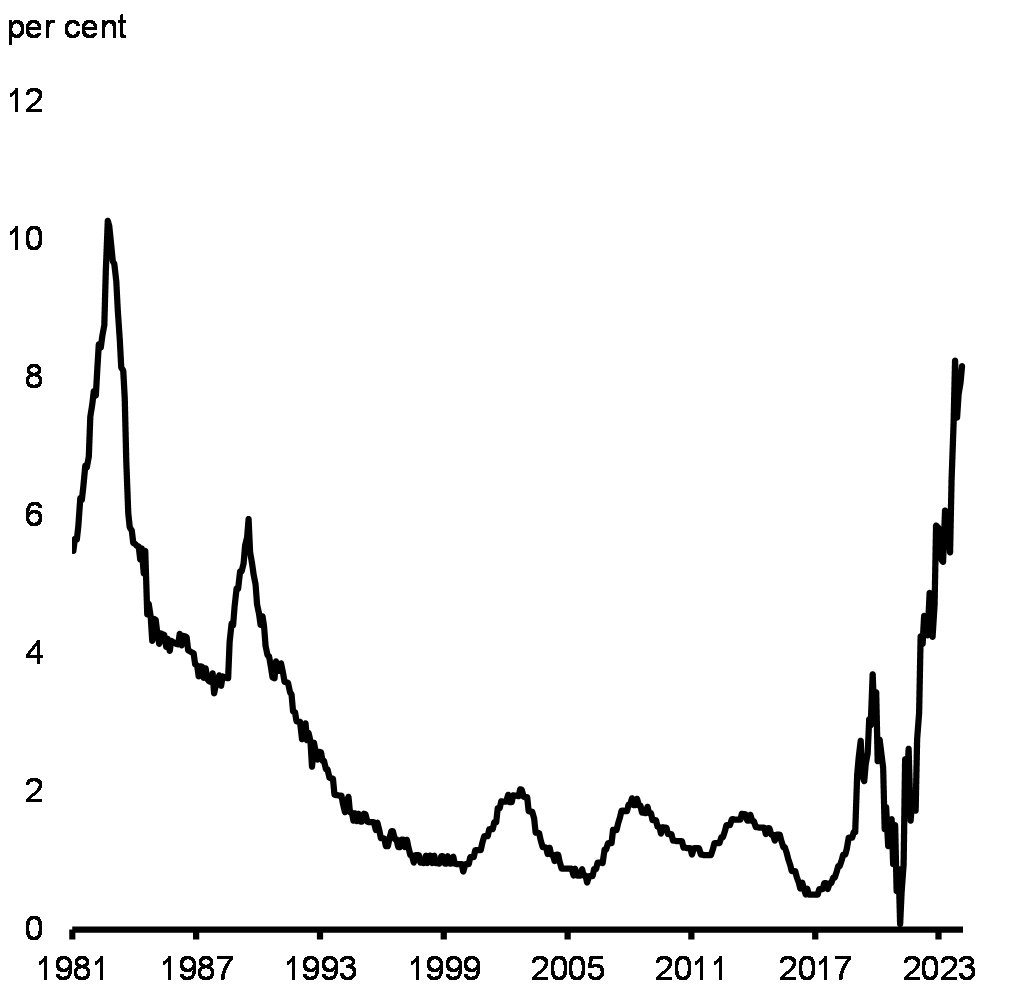

The monthly analysis of the US Consumer Price Index has significant implications for the economy. A rising CPI can erode purchasing power, reduce consumer spending, and increase production costs for businesses. On the other hand, a moderate level of inflation can be beneficial for economic growth, as it can stimulate spending and investment.The Federal Reserve, the US central bank, closely monitors the CPI and uses it as a guide for setting monetary policy. The Fed's target inflation rate is 2%, and it uses interest rates and other tools to keep inflation within this target range.

In conclusion, the US Consumer Price Index is a critical economic indicator that provides insights into the state of inflation in the economy. The monthly analysis of the CPI, using data from YCharts, reveals that housing and healthcare costs have been significant drivers of inflation. As the economy continues to grow, it is essential to monitor the CPI closely, as it can have significant implications for monetary policy, consumer behavior, and economic growth.By understanding the trends and drivers of the CPI, businesses, investors, and policymakers can make informed decisions and navigate the complexities of the US economy. Whether you are a consumer, investor, or business leader, staying up-to-date with the latest CPI data and analysis is crucial for success in today's fast-paced economic environment.